The Scottish Mortgage Investment Trust (SMT) has consistently captured the attention of investors, making its share price a subject of keen interest. This article delves into the factors influencing SMT’s performance, explores its investment strategy, and provides insights for potential investors.

Understanding the Scottish Mortgage Investment Trust

SMT is a closed-end investment trust listed on the London Stock Exchange. Unlike open-ended funds, it has a fixed number of shares, allowing it to invest in illiquid assets like private companies. Its investment philosophy revolves around long-term growth, focusing on innovative companies across various sectors, including technology, healthcare, and renewable energy.

Key Factors Influencing SMT’s Share Price

Several factors significantly impact SMT’s share price:

Global Economic Conditions: The global economic landscape plays a crucial role. Strong economic growth generally favors growth stocks, which form a significant portion of SMT’s portfolio. Conversely, economic downturns or periods of high inflation can negatively impact the trust’s performance.

Interest Rates: Rising interest rates can impact the valuation of growth stocks, as they often have higher future earnings expectations. Higher interest rates can make bonds more attractive, potentially diverting capital away from equities.

Performance of Portfolio Companies: The performance of SMT’s underlying investments is paramount. Successes by companies like Tesla, Amazon, and other holdings in the trust can significantly boost its share price. Conversely, underperformance or significant losses by key holdings can negatively impact the trust.

Investor Sentiment: Market sentiment towards growth stocks and the overall investment climate can influence investor demand for SMT shares. Periods of high investor optimism can drive up the share price, while periods of risk aversion can lead to a decline.

Discount/Premium to Net Asset Value (NAV): SMT’s share price often trades at a discount or premium to its NAV. This reflects investor sentiment and the perceived value of the trust’s portfolio. A premium indicates that investors believe the trust’s shares are undervalued relative to the underlying assets.

SMT’s Investment Strategy: A Focus on Innovation

SMT’s investment strategy is characterized by a long-term horizon and a focus on innovative companies. The trust invests globally, seeking out companies that are disrupting industries and driving technological advancements.

Key Investment Areas:

Technology: A significant portion of SMT’s portfolio is allocated to technology companies, including software, e-commerce, and artificial intelligence.

Healthcare: The trust invests in companies developing innovative therapies, medical devices, and healthcare technologies.

Renewable Energy: SMT recognizes the growing importance of renewable energy and invests in companies involved in solar, wind, and other clean energy technologies.

Private Companies: The trust invests in private companies, providing access to high-growth opportunities that may not be available through public markets.

The Scottish Mortgage Investment Trust (SMT) has garnered significant attention from investors, making its share price a frequent topic of discussion. This article delves into the key aspects of SMT, including its investment strategy, recent performance, and factors influencing its share price.

What is the Scottish Mortgage Investment Trust?

Scottish Mortgage is a closed-end investment trust that invests globally across a diverse range of companies, with a strong focus on growth and innovation. It has a long-term investment horizon and seeks to capitalize on disruptive technologies and companies with high growth potential.

Key Investment Strategies

SMT’s investment philosophy revolves around:

Global Diversification: Investing in companies across various sectors and geographies, reducing exposure to localized risks.

Long-Term Focus: A patient investment approach, aiming to capture long-term growth trends rather than short-term market fluctuations.

Innovation and Disruption: Identifying and investing in companies at the forefront of technological advancements, such as artificial intelligence, biotechnology, and renewable energy.

Active Management: A team of experienced investment professionals actively selects and monitors investments, adapting the portfolio to evolving market conditions.

Factors Influencing the Share Price

Several factors can significantly impact SMT’s share price:

Global Economic Conditions: Overall economic growth, interest rates, and inflation all influence investor sentiment and market valuations.

Performance of Underlying Investments: The success of SMT’s portfolio companies directly impacts its performance and, consequently, its share price.

Market Sentiment: Investor sentiment towards growth stocks and technology companies can significantly impact SMT’s valuation.

Discount/Premium to Net Asset Value (NAV): As a closed-end fund, SMT’s share price can trade at a discount or premium to its NAV, which can influence its relative attractiveness to investors.

Competitive Landscape: The performance of other investment trusts and funds with similar investment strategies can impact investor demand for SMT.

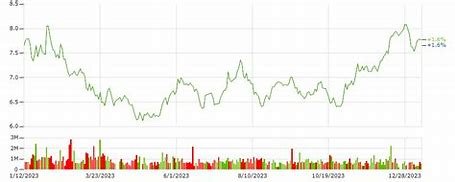

Recent Performance and Trends

SMT has historically delivered strong long-term returns, although it has experienced periods of volatility. In recent years, the trust has benefited from the strong performance of technology companies, particularly those involved in areas like cloud computing, e-commerce, and artificial intelligence.

Why is the “Scottish Mortgage Investment Trust Share Price” Trending?

The “Scottish Mortgage Investment Trust Share Price” is likely trending due to several reasons:

Strong Historical Performance: SMT’s long-term track record of delivering attractive returns has attracted significant investor interest.

Focus on Growth and Innovation: With the increasing importance of technology and innovation in the global economy, SMT’s investment strategy aligns with many investors’ long-term goals.

Market Volatility: In periods of market uncertainty, investors often seek out high-growth, long-term investment opportunities, which may have increased interest in SMT.

Media Coverage: Frequent media coverage of SMT’s performance, investment strategy, and portfolio holdings can contribute to increased public awareness and interest.

FAQs

What is the current share price of Scottish Mortgage Investment Trust?

As of December 13, 2024, the share price of Scottish Mortgage Investment Trust (SMT) was approximately 975.20 pence. Please note that share prices fluctuate regularly due to market conditions. For the most current information, consult a reliable financial news source or brokerage platform.

What factors influence the share price of Scottish Mortgage Investment Trust?

The share price is influenced by the performance of its underlying investments, market sentiment, global economic conditions, and the demand-supply dynamics of the shares themselves. Significant market events, changes in the technology sector, and company-specific news can also impact the share price.

Is Scottish Mortgage Investment Trust currently trading at a discount or premium to its Net Asset Value (NAV)?

As of December 13, 2024, the shares were trading at a discount of approximately 11.56% to the NAV. This means the share price was lower than the per-share value of its underlying assets. Discounts and premiums can change over time based on market conditions and investor sentiment.

What is the dividend yield of Scottish Mortgage Investment Trust?

The annual dividend yield is around 0.39%. While the trust focuses primarily on capital growth, it has a history of paying dividends, with a total payout for the year up 3.4% to 4.24 pence per share.

What is the ongoing charge for investing in Scottish Mortgage Investment Trust?

The audited ongoing charge is 0.35%, which is relatively low compared to other actively managed funds. This fee covers the costs of managing the trust and is deducted from the trust’s assets.

Has Scottish Mortgage Investment Trust announced any share buyback programs?

Yes, in March 2024, the trust announced a £1 billion share buyback program over two years to address the discount to NAV and enhance shareholder value. This initiative aims to support the share price by reducing the number of shares in circulation.

Where can I find more information about Scottish Mortgage Investment Trust?

For detailed information, including the latest reports and updates, visit the official website or consult financial news platforms and investment research websites.

In summary

The Scottish Mortgage Investment Trust is a prominent player in the global investment landscape, offering investors exposure to a diversified portfolio of high-growth companies. While past performance does not guarantee future results, SMT’s long-term track record and focus on innovation make it an intriguing investment option for those with a long-term investment horizon and a willingness to accept some level of risk.

To read more, click here.