The Euro (€), the official currency of 20 of the 27 member states of the European Union (the Eurozone), is a major player in the global financial system. Understanding the Euro exchange rate – its fluctuations, the forces that drive it, and its impact on the world economy – is crucial for businesses, travelers, investors, and policymakers alike. This comprehensive guide delves into the intricacies of the Euro exchange rate, exploring its historical context, the key factors that influence its movements, and offering insights into forecasting its potential future direction.

Understanding the Basics: What is the Euro Exchange Rate?

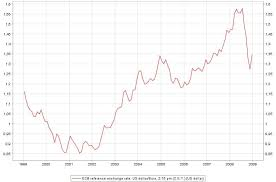

The Euro exchange rate represents the value of the Euro in relation to other currencies. It’s typically expressed as the price of one Euro in terms of another currency. For example, if the EUR/USD exchange rate is 1.10, it means that 1 Euro can be exchanged for 1.10 US Dollars. Conversely, if the EUR/JPY exchange rate is 150, it means that 1 Euro can be exchanged for 150 Japanese Yen. These rates are constantly fluctuating, reflecting the dynamic nature of the currency market.

A Historical Perspective: From ECU to Euro

The Euro’s journey is rooted in European integration and the desire for greater economic cooperation.

European Currency Unit (ECU): Before the Euro, the European Currency Unit (ECU) was used as a basket currency for member states of the European Economic Community. It served as a precursor to the single currency.

Introduction of the Euro: The Euro was launched on January 1, 1999, as a virtual currency for accounting purposes and then physically introduced on January 1, 2002, replacing the national currencies of the participating countries.

Expansion of the Eurozone: Initially, 11 member states adopted the Euro. Over time, the Eurozone has expanded to include 20 countries.

Global Role: The Euro has become the second most widely held reserve currency in the world, after the US Dollar, and plays a significant role in international trade and finance.

Factors Influencing the Euro Exchange Rate

Several key factors influence the Euro exchange rate, contributing to its daily fluctuations:

Interest Rate Differentials: Central bank interest rates play a crucial role. If the European Central Bank (ECB) raises interest rates relative to another central bank (e.g., the Federal Reserve for the US Dollar), it becomes more attractive for investors to hold Euros, increasing demand and potentially strengthening the Euro.

Economic Growth: Strong economic growth in the Eurozone can positively impact the Euro’s value. Conversely, weaker economic performance can put downward pressure on the currency.

Inflation: Inflation rates influence purchasing power and currency values. Higher inflation in the Eurozone compared to other regions could lead to a depreciation of the Euro, as its purchasing power decreases.

Political Stability: Political uncertainty or instability within the Eurozone can negatively impact investor confidence and lead to capital flight, weakening the Euro.

Government Debt and Fiscal Policy: Concerns about sovereign debt levels and fiscal policies within Eurozone member states can affect the Euro’s value.

Trade Balances: The Eurozone’s trade balance (exports minus imports) can influence its currency. A trade surplus can increase demand for the Euro, while a trade deficit can put downward pressure on it.

Global Economic Conditions: Global events, such as financial crises, pandemics, or geopolitical tensions, can significantly impact investor sentiment and lead to shifts in currency valuations.

Market Speculation: Currency traders and speculators can influence exchange rates through their buying and selling activities. Large buy or sell orders can create momentum and push the exchange rate in a particular direction.

Forecasting the Euro Exchange Rate: Challenges and Approaches:

Predicting currency movements is notoriously difficult. The multitude of influencing factors, their complex interactions, and the unpredictable nature of global events make accurate forecasting a significant challenge. However, several approaches are used to analyze and forecast exchange rates:

Fundamental Analysis: This approach involves studying macroeconomic factors like economic growth, inflation, interest rates, trade balances, and political developments to assess the long-term value of a currency.

Technical Analysis: This method uses historical price and volume data to identify patterns and trends, which are then used to predict future price movements. Technical analysts use various tools, such as moving averages, chart patterns, and indicators, to analyze currency charts.

Market Sentiment Analysis: This approach attempts to gauge the overall mood and expectations of market participants. News headlines, social media sentiment, and surveys of market professionals can provide insights into market sentiment.

Quantitative Models: Sophisticated statistical models are used to identify relationships between different economic variables and predict exchange rate movements.

Implications of the Euro Exchange Rate

The Euro exchange rate has significant implications for various stakeholders:

Businesses: Businesses engaged in international trade within the Eurozone or with other countries are directly affected by the exchange rate. Fluctuations can impact the cost of imports and exports, affecting profitability.

Tourists: The exchange rate impacts the cost of travel to and from the Eurozone. A stronger Euro makes travel to the Eurozone more expensive for those using other currencies, while a weaker Euro makes it more affordable.

Investors: Investors holding assets in Euro-denominated securities or other investments are exposed to exchange rate risk. Fluctuations in the Euro exchange rate can impact the value of their investments when converted back to their home currency.

Governments: Eurozone governments are concerned about the impact of exchange rate movements on their economies. A strong Euro can make exports less competitive, while a weak Euro can lead to higher import prices and inflation.

Consumers: The Euro exchange rate can indirectly affect consumers through the prices of imported goods and services.

FAQs

What is the Euro exchange rate and how is it quoted?

The Euro exchange rate represents the value of the Euro in relation to another currency. It’s quoted as the price of one Euro in terms of the other currency. For example, EUR/USD = 1.10 means 1 Euro is worth 1.10 US Dollars. EUR/JPY = 150 means 1 Euro can be exchanged for 150 Japanese Yen. These rates are constantly changing.

Where can I find the current Euro exchange rate?

Real-time or near real-time Euro exchange rates are readily available online. Reputable financial websites like the European Central Bank’s website, Bloomberg, Reuters, Google Finance, and XE.com are excellent resources. Most banks and currency exchange bureaus also display current rates on their websites and in their branches. Remember that the displayed rate is usually a “mid-market” rate, and the actual rate you get when exchanging currency might be slightly different due to fees and markups.

How often does the Euro exchange rate change?

The Euro exchange rate is dynamic, changing constantly, 24 hours a day, five days a week (excluding weekends and some holidays). The global currency market operates continuously, with transactions constantly influencing the rate.

What factors influence the Euro exchange rate?

Several key factors drive the Euro exchange rate:

Interest Rate Differentials: The difference in interest rates between the European Central Bank (ECB) and other central banks (e.g., the Federal Reserve for the USD) is a major influence. Higher interest rates in the Eurozone tend to attract foreign investment, increasing demand for the Euro.

Economic Growth: Strong economic performance in the Eurozone generally supports the Euro’s value. Conversely, weaker economic data can put downward pressure on the currency.

Inflation: Inflation rates affect purchasing power and currency values. Higher inflation in the Eurozone compared to other regions can lead to Euro depreciation.

Political Stability: Political uncertainty or instability within the Eurozone can negatively impact investor confidence and weaken the Euro.

Government Debt and Fiscal Policy: Concerns about sovereign debt levels and fiscal sustainability in Eurozone member states can influence the Euro’s value.

Trade Balances: The Eurozone’s trade balance (exports minus imports) can affect its currency. A trade surplus can increase demand for the Euro, while a deficit can weaken it.

Global Economic Conditions: Global events, such as financial crises, pandemics, or geopolitical tensions, can significantly impact investor sentiment and cause shifts in currency valuations.

Market Speculation: Currency traders and speculators can influence exchange rates through their buying and selling activities.

In Summary

The Euro exchange rate is a complex and constantly fluctuating variable, influenced by a wide range of economic, political, and global factors. Understanding these factors and their interplay is essential for businesses engaged in international trade, tourists traveling to the Eurozone, investors managing global portfolios, and anyone dealing with Euro-related transactions.

While predicting currency movements is notoriously difficult, analyzing historical trends, understanding current economic conditions, and staying informed about global events can provide valuable insights. It’s also important to remember that exchange rates are inherently volatile, and considering hedging strategies to mitigate potential risks is prudent, especially for large transactions. By staying informed and understanding the dynamics of the Euro exchange rate, individuals and businesses can navigate the complexities of the global currency market more effectively.

Whether you’re a businessperson managing international transactions or a tourist planning a trip to Europe, a solid grasp of the Euro exchange rate is a valuable asset in today’s interconnected world. Being informed and proactive will allow you to make better financial decisions and minimize the impact of currency fluctuations on your finances.

To read more, Click here.