The exchange rate between the US Dollar (USD) and the Russian Ruble (RUB) is a critical indicator of the economic and financial relationship between the United States and Russia. This rate, constantly fluctuating, reflects a complex interplay of global and domestic factors. Understanding the USD/RUB exchange rate is crucial for businesses, investors, travelers, and anyone involved in transactions between these two countries. This comprehensive guide delves into the intricacies of the USD/RUB exchange rate, exploring its historical context, the key factors that drive its movements, and offering insights into potential future trends.

Understanding the Basics: What Does Dollar to Ruble Mean?

The USD/RUB exchange rate represents how many Russian Rubles (RUB) are needed to purchase one US Dollar (USD). For example, if the USD/RUB exchange rate is 70, it means that 70 Russian Rubles are required to buy 1 US Dollar. If the rate rises (e.g., to 75), the Dollar has strengthened (appreciated) against the Ruble – it now takes more Rubles to buy one Dollar. Conversely, if the rate falls (e.g., to 65), the Dollar has weakened (depreciated) against the Ruble, requiring fewer Rubles to purchase one Dollar.

A Historical Perspective: Tracing the Dollar-Ruble Relationship

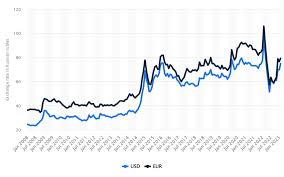

The relationship between the Dollar and the Ruble has been marked by periods of stability and significant volatility, reflecting the evolving economic and political landscape.

Soviet Era: During the Soviet era, the Ruble was a centrally planned currency with a fixed exchange rate against the Dollar. This rate was largely insulated from market forces.

Post-Soviet Transition: After the collapse of the Soviet Union, Russia transitioned to a market-based economy, leading to the liberalization of the exchange rate. This transition period was marked by significant economic instability and Ruble depreciation.

Ruble Crisis: Russia experienced several Ruble crises, notably in 1998 and 2014, triggered by a combination of factors, including declining oil prices, economic sanctions, and investor uncertainty. These crises led to sharp declines in the Ruble’s value.

Managed Float: Russia operates a managed floating exchange rate regime, where the Ruble’s value is primarily determined by market forces, but the Central Bank of Russia (CBR) intervenes to manage excessive volatility.

Recent Trends: The USD/RUB exchange rate continues to be influenced by a complex interplay of global and domestic factors, including oil prices, economic sanctions, interest rate differentials, political developments, and global economic conditions.

Factors Influencing the Dollar to Ruble Exchange Rate

Several key factors influence the USD/RUB exchange rate, contributing to its frequent fluctuations:

Oil Prices: Russia is a major oil exporter, and oil prices are a significant driver of the Russian economy and the Ruble’s value. Declining oil prices often put downward pressure on the Ruble.

Economic Sanctions: International sanctions imposed on Russia can significantly impact investor confidence and capital flows, leading to Ruble depreciation.

Interest Rate Differentials: The difference in interest rates between the US Federal Reserve and the Central Bank of Russia can influence currency flows. Higher interest rates in the US can attract investment, strengthening the Dollar.

Economic Growth: Strong economic growth in either the US or Russia can impact the respective currencies.

Inflation: Inflation rates influence purchasing power and currency values. Higher inflation in Russia compared to the US can put downward pressure on the Ruble.

Political Stability: Political uncertainty or instability in Russia can negatively impact investor confidence and weaken the Ruble.

Global Economic Conditions: Global events, such as financial crises, pandemics, or geopolitical tensions, can significantly impact investor sentiment and lead to shifts in currency valuations.

Market Speculation: Currency traders and speculators can influence exchange rates through their buying and selling activities. Large buy or sell orders can create momentum and push the exchange rate in a particular direction.

CBR Intervention: The Central Bank of Russia can intervene in the foreign exchange market to manage the Ruble’s value, buying or selling currency to influence the exchange rate.

Forecasting the Dollar to Ruble Exchange Rate: Challenges and Approaches

Predicting currency movements is notoriously difficult. The multitude of influencing factors, their complex interactions, and the unpredictable nature of global events make accurate forecasting a significant challenge. However, several approaches are used to analyze and forecast exchange rates:

Fundamental Analysis: This approach involves studying macroeconomic factors like economic growth, inflation, interest rates, trade balances, and political developments to assess the long-term value of a currency.

Technical Analysis: This method uses historical price and volume data to identify patterns and trends, which are then used to predict future price movements. Technical analysts use various tools, such as moving averages, chart patterns, and indicators, to analyze currency charts.

Market Sentiment Analysis: This approach attempts to gauge the overall mood and expectations of market participants. News headlines, social media sentiment, and surveys of market professionals can provide insights into market sentiment.

Quantitative Models: Sophisticated statistical models are used to identify relationships between different economic variables and predict exchange rate movements.

Implications of the Dollar to Ruble Exchange Rate

The USD/RUB exchange rate has significant implications for various stakeholders:

Businesses: Businesses engaged in international trade between the US and Russia are directly affected by the exchange rate. A stronger Dollar makes US exports to Russia more expensive, while Russian imports to the US become cheaper. Conversely, a weaker Dollar has the opposite effect.

Tourists: The exchange rate impacts the cost of travel between the US and Russia. A stronger Dollar makes travel to Russia more affordable for US tourists, while a weaker Dollar makes it more expensive.

Investors: Investors holding assets in either currency are exposed to exchange rate risk. Fluctuations in the USD/RUB rate can impact the value of their investments when converted back to their home currency.

Remittances: Individuals sending money between the US and Russia are affected by the exchange rate. A stronger Dollar means recipients in Russia receive more Rubles, while a weaker Dollar results in fewer Rubles.

Governments: Governments are concerned about the impact of exchange rate movements on their economies. A strong currency can make exports less competitive, while a weak currency can lead to higher import prices and inflation.

FAQs

What does “Dollar to Ruble” mean?

“Dollar to Ruble” refers to the exchange rate between the US Dollar and the Russian Ruble. It specifically indicates how many Russian Rubles are needed to purchase one US Dollar. For example, if the rate is 70, it means 70 Rubles are required to buy 1 Dollar. This rate is constantly changing based on various market forces.

Where can I find the current Dollar to Ruble exchange rate?

Up-to-the-minute USD/RUB exchange rates are readily available online. Reputable financial websites like the Central Bank of Russia’s website, Bloomberg, Reuters, Google Finance, and XE.com are excellent resources. Many banks and currency exchange bureaus also display current rates on their websites and in their branches. Remember that the displayed rate is usually a “mid-market” rate, and the actual rate you receive when exchanging currency might be slightly different due to fees and markups.

How often does the Dollar to Ruble exchange rate change?

The Dollar to Ruble exchange rate is in constant flux, changing 24 hours a day, five days a week (excluding weekends and some holidays). The global currency market operates continuously, with transactions constantly influencing the rate. Even seemingly small changes can become significant, especially for large currency exchanges.

What factors influence the Dollar to Ruble exchange rate?

Several key factors drive the Dollar to Ruble exchange rate:

Oil Prices: Russia is a major oil exporter, and oil price fluctuations have a significant impact on the Russian economy and the Ruble’s value. Declining oil prices often weaken the Ruble.

Economic Sanctions: International sanctions imposed on Russia can significantly impact investor confidence and capital flows, often leading to Ruble depreciation.

Interest Rate Differentials: The difference in interest rates between the US Federal Reserve and the Central Bank of Russia can influence currency flows. Higher interest rates in the US can attract investment, strengthening the Dollar.

Economic Growth: Strong economic growth in either the US or Russia can impact the respective currencies.

Inflation: Inflation rates influence purchasing power and currency values. Higher inflation in Russia compared to the US can put downward pressure on the Ruble.

Political Stability: Political uncertainty or instability in Russia can negatively impact investor confidence and weaken the Ruble.

Global Economic Conditions: Global events, such as financial crises, pandemics, or geopolitical tensions, can significantly impact investor sentiment and lead to shifts in currency valuations.

Market Speculation: Currency traders and speculators can influence exchange rates through their buying and selling activities. Large buy or sell orders can create momentum and push the exchange rate in a particular direction.

Central Bank Intervention: The Central Bank of Russia can intervene in the foreign exchange market to manage the Ruble’s value, buying or selling currency to influence the exchange rate.

Is it a good time to buy Rubles with Dollars, or vice versa?

There’s no single “best” time to exchange currencies. The exchange rate is constantly moving, and predicting its short-term movements is very difficult. It’s generally advisable to monitor the rate and exchange when you find a favorable rate, especially if you have a specific need for the currency. Trying to perfectly time the market is often a fruitless endeavor.

In Summary

The USD/RUB exchange rate is a dynamic and important indicator of the economic and financial relationship between the US and Russia. Understanding the factors that drive its fluctuations is essential for businesses engaged in international trade, tourists planning trips, investors managing global portfolios, and anyone involved in transactions between these two countries.

While predicting currency movements is notoriously difficult, analyzing historical trends, understanding current economic conditions, and staying informed about global events can provide valuable insights. It’s also important to remember that exchange rates are inherently volatile, and it’s prudent to consider hedging strategies to mitigate potential risks. By staying informed and understanding the dynamics of the USD/RUB exchange rate, individuals and businesses can navigate the complexities of the global currency market more effectively.

Whether you’re a businessperson managing international transactions or a tourist preparing for a trip to Russia, a solid grasp of the USD/RUB exchange rate is a valuable asset. Being informed and proactive will help you navigate the complexities of currency exchange with greater confidence and efficiency.

To read more, Click here.